Blog

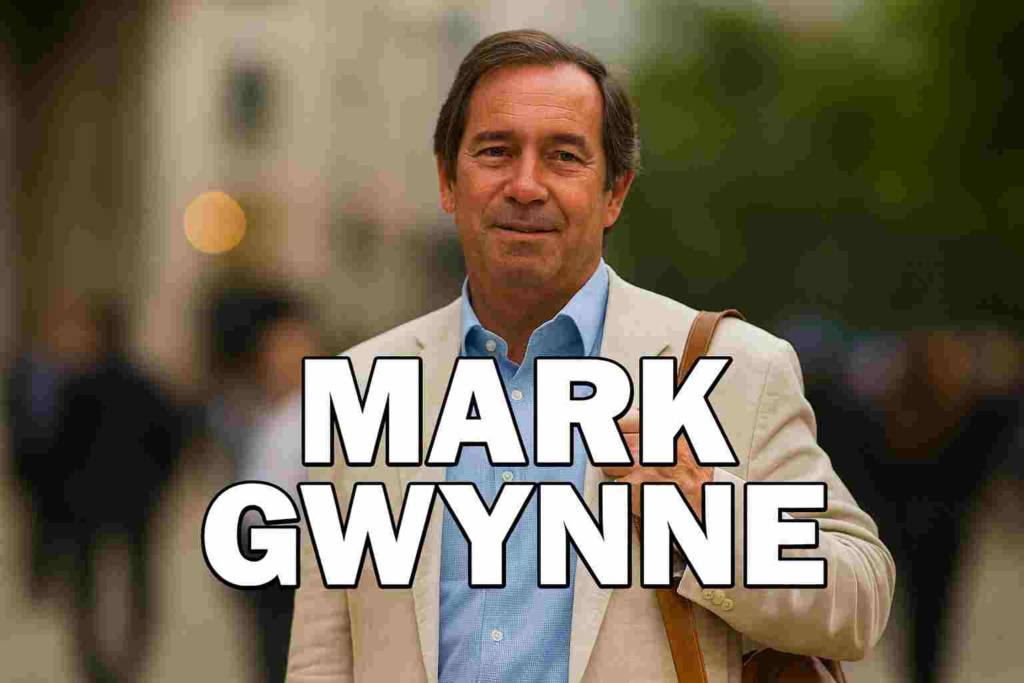

mark-gwynne: The Quiet Force Behind Modern Finance

In the fast-paced world of finance, where names of CEOs, traders, and media personalities often dominate headlines, there exist professionals whose influence is profound yet understated. Mark Gwynne is one such individual—a highly respected investment strategist, portfolio manager, and financial leader whose work has shaped investment thinking and contributed to the stability and growth of major financial institutions.

While not a household name, Mark Gwynne career is a testament to disciplined strategy, intellectual rigor, and a long-term approach to wealth creation. His professional journey, personal life, and philosophy offer valuable insights into how finance can be navigated with intelligence, prudence, and integrity.

Early Life and Education

Mark Gwynne was born and raised in the United Kingdom, where his early education emphasized critical thinking and analytical skills. From a young age, he displayed a natural curiosity about numbers, markets, and human decision-making. This curiosity guided him toward a path that combined rigorous academic training with practical financial knowledge.

He attended some of the country’s leading schools, where intellectual development and exposure to a wide range of subjects prepared him for future challenges. Early mentors and teachers recognized his analytical abilities and encouraged him to pursue fields that required both precision and strategic thinking.

After completing secondary education, Gwynne progressed to one of the United Kingdom’s most prestigious universities. There, he studied subjects that honed his skills in logic, analysis, and critical reasoning. His academic training provided a solid foundation for understanding complex financial systems, corporate structures, and economic principles, which later became central to his professional success.

Entering the Financial World

Mark Gwynne began his professional career in investment management and equity capital markets, an area of finance focused on helping companies raise capital while managing risk and growth. Early in his career, he demonstrated exceptional analytical skills, strategic insight, and the ability to navigate complex financial transactions.

His initial roles involved research, market analysis, and supporting corporate clients through financial decisions. He quickly developed a reputation for being methodical, disciplined, and highly reliable—qualities that would define his entire career. Unlike professionals who chase headlines or short-term gains, Gwynne built his reputation on careful planning, deep market understanding, and consistent results.

Over time, he took on more senior positions, gaining experience in investment banking, portfolio management, and strategic oversight. Each step in his career reinforced his philosophy: successful finance requires patience, critical thinking, and a long-term perspective rather than reactive decision-making.

Career Highlights

One of the defining aspects of Mark Gwynne’s career is his role in portfolio management at leading investment firms. He has been instrumental in shaping strategies that focus on sustainable growth, risk management, and market stability.

Gwynne’s approach to finance emphasizes understanding the fundamentals of businesses, evaluating market trends, and making strategic investment decisions that balance potential gains with long-term risk. He has managed complex investment portfolios, including multi-strategy funds, where his decisions directly impacted returns and client trust.

In addition to portfolio management, Gwynne has provided strategic oversight for large-scale equity capital projects. His ability to assess market opportunities, anticipate potential challenges, and create frameworks for decision-making has made him a respected advisor within the institutions he has served.

Investment Philosophy

Mark Gwynne’s investment philosophy can be distilled into several core principles:

1. Focus on Long-Term Value

Gwynne prioritizes sustainable growth over short-term speculation. While many traders react to market fluctuations, he focuses on businesses with solid fundamentals and long-term potential.

2. Analytical Rigor

Every investment decision is backed by extensive analysis. Gwynne evaluates data, market trends, and macroeconomic factors to ensure that his strategies are well-informed and resilient.

3. Risk Management

Understanding and mitigating risk is central to his approach. Gwynne designs investment strategies that aim to maximize returns while protecting against unforeseen market events.

4. Steadfast Leadership

Gwynne’s leadership style emphasizes reliability and consistency. He leads teams with calm authority, fostering environments where strategic thinking is valued over impulsive decision-making.

These principles have guided his career and helped him navigate volatile markets, global economic shifts, and changing regulatory environments.

Personal Life

Mark Gwynne is known not only for his professional achievements but also for maintaining a balanced personal life. He is married and has a family, finding time to prioritize both his career and personal responsibilities. He lives a relatively private life, avoiding the constant spotlight that often accompanies figures in the financial world.

Balancing high-stakes work with family and personal commitments reflects Gwynne’s belief in stability, responsibility, and thoughtful living. This approach mirrors his professional philosophy: measured, deliberate, and focused on long-term outcomes.

Reputation in the Financial World

Within professional circles, Mark Gwynne is recognized for his integrity, analytical skills, and disciplined decision-making. Colleagues describe him as calm under pressure, thoughtful, and consistent. His influence extends beyond individual investment decisions; he is known for mentoring junior analysts, shaping strategic direction, and promoting sound financial practices.

Unlike media-focused figures in finance, Gwynne’s reputation is built on performance and reliability rather than publicity. This has earned him respect among peers, clients, and industry observers alike.

Lessons from Mark Gwynne’s Career

Mark Gwynne’s professional journey offers valuable lessons for aspiring finance professionals and anyone interested in strategic decision-making:

- Patience is key: Long-term thinking often produces more reliable outcomes than chasing short-term gains.

- Data-driven decisions: Analytical rigor and research underpin effective strategy.

- Balance is essential: Maintaining a healthy personal and professional life contributes to sustainable success.

- Leadership matters: Guiding teams with calm authority fosters trust, collaboration, and consistent results.

These lessons illustrate that success in finance—or any high-pressure field—is rarely about shortcuts or showmanship. Instead, it is built on discipline, analysis, and a commitment to long-term objectives.

Contributions Beyond Investment

While Mark Gwynne primarily works in finance, his influence extends into broader professional spheres. He has contributed to mentoring programs, financial strategy discussions, and educational initiatives within his institutions. By sharing knowledge and expertise, Gwynne helps cultivate a culture of informed decision-making and ethical practice in investment management.

His approach emphasizes that financial success is not just about profits but also about guiding institutions and individuals toward responsible, sustainable financial practices. This commitment to ethical, informed decision-making reflects a deeper philosophy about the role of finance in society.

The Balance of Privacy and Professional Influence

One of the most notable aspects of Mark Gwynne’s life is his ability to maintain privacy while achieving significant professional influence. In an era where financial figures often become media personalities, Gwynne’s discretion sets him apart. He allows his work and results to define his reputation rather than public exposure or social media presence.

This balance between private life and professional impact reflects a deliberate choice to focus on substance over style—a principle that echoes throughout his career and investment philosophy.

Net Worth and Financial Standing

While Mark Gwynne keeps his personal finances private, his decades-long career in investment management and portfolio strategy suggest that his net worth reflects both professional success and long-term financial planning. He exemplifies how disciplined investment, strategic leadership, and career longevity can create stability and wealth without the need for public attention.

The Legacy of Mark Gwynne

Mark Gwynne’s legacy in the financial world is defined by influence, reliability, and strategic thinking. Unlike more public-facing figures, his contributions are often subtle but enduring. By focusing on disciplined investment strategies, mentoring emerging professionals, and promoting long-term planning, he has helped shape the practices and standards within his field.

His career offers a model for professionals who aspire to make meaningful contributions without seeking fame: impact comes from expertise, ethical practice, and thoughtful decision-making, rather than visibility alone.

Conclusion

Mark Gwynne is a quintessential example of a professional whose influence is felt quietly but powerfully. Through decades of work in investment management, equity capital markets, and portfolio strategy, he has demonstrated that discipline, analytical rigor, and long-term thinking are the keys to sustained success.

While he maintains a private personal life, his professional contributions have shaped investment practices, guided institutional decisions, and mentored the next generation of financial leaders. His approach—substance over style, analysis over hype, and patience over impulse—offers a blueprint for anyone seeking to navigate high-stakes environments effectively.

In an era dominated by public personas and media-driven reputations, Mark Gwynne’s career reminds us that true influence is often quiet, deliberate, and enduring. His life and work serve as a testament to the power of thoughtful strategy, disciplined execution, and ethical practice in finance and beyond.

-

CALEBRITIES7 days ago

CALEBRITIES7 days agoLiza Tarbuck Illness: Health, Career, and Public Awareness

-

CALEBRITIES4 days ago

CALEBRITIES4 days agoEileen Catterson Today: The Life, Legacy, and Private Journey of Scotland’s Elegant Muse

-

Business4 days ago

Business4 days agoson simon now simon anthony blackburn: From Celebrity Son to Private Life

-

CALEBRITIES3 weeks ago

CALEBRITIES3 weeks agoBlake Horstmann Bachelorette: A Deep Dive into His Journey and Impact on the Show

-

Blog2 weeks ago

Blog2 weeks agoEmily Sheen Pauline Quirke Daughter: A Story of Family, Privacy, and Life Beyond the Spotlight

-

Entertainment6 days ago

Entertainment6 days agoWhere Was Jennifer Bartram Born: A Deep Dive Into Her Early Life, Roots, and Journey

-

Business2 weeks ago

Business2 weeks agoIs Peter Cardwell Married? A Deep Dive Into His Life, Career, and Personal Relationships

-

Entertainment3 days ago

Entertainment3 days agoBabs Lord Now: From Television Star to Adventurer and Philanthropist